Customer demand for high-quality digital banking services is enforcing a competitive pressure for banks to develop solutions tailored to providing this level of service. This has presented the need for banks to transform the way they provide digital solutions for their customers. There is a need for banks to deliver five-star solutions capable of providing customers with a more personalized and hassle-free experience.

To enable independent software vendors (ISVs), customers, and partners to quickly build efficient data-driven solutions, Microsoft introduced Industrial Accelerators. These are setups with the foundational components which can be leveraged to build solutions that meet and surpass the industry standard. Solutions based on industrial accelerators are powered by Microsoft’s Power Platform and Dynamics 365. Dynamics 365 Financial Services Accelerator is one such industrial accelerator that enables ISVs to quickly develop powerful, data-driven financial service solutions on Microsoft’s Power Platform.

Solving the current digital gap for retail and commercial banking

There is a massive digital gap in the current functional model for both retail and commercial banking. This is because functional business silos and changing business processes create digital gaps within functions. For banking, data is stored within internal silos, such as mobile/web, and external silos such as social networks. This creates a disparity since data is stored and defined in different ways. There is a lot of hanging information and the result of this is that customers will have a poor experience leading to them abandoning the financial services provider.

Dynamics 365 Financial Services ensures this does not happen by providing a shared industry-standard data model, with a common way of defining this data known as the Common Data Model for financial services. The unified definition of data ensures that ISVs can easily integrate data into their applications to generate robust, data-driven solutions. Dynamics 365 Financial Services accelerator is an extension of the Common Data Model that is meant for this industry along with sample apps, data, and dashboards.

Key features of the financial services accelerator

Built to deliver the best customer experience

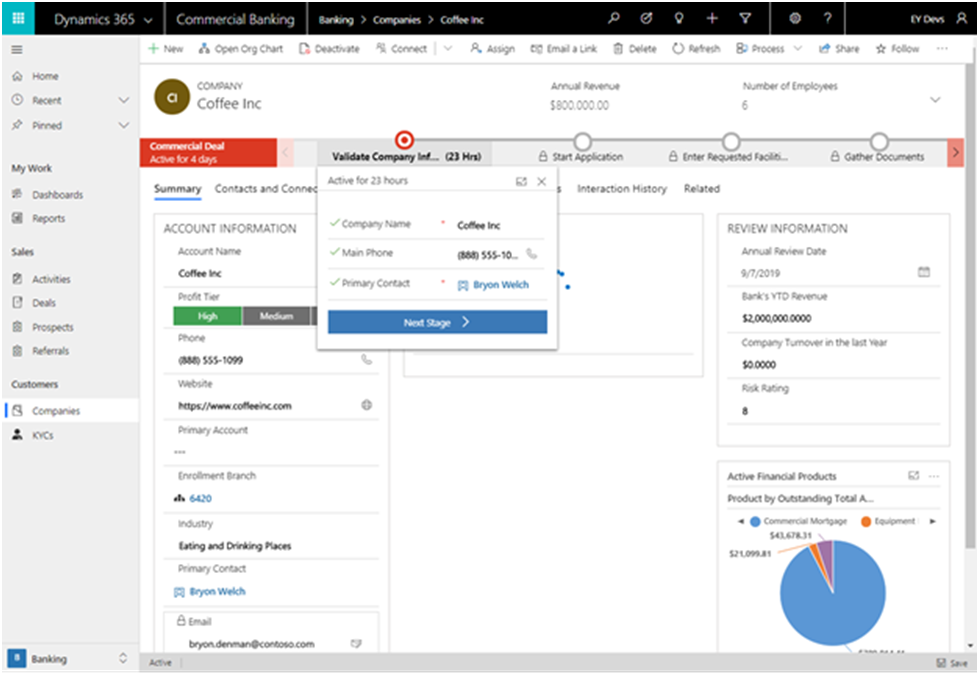

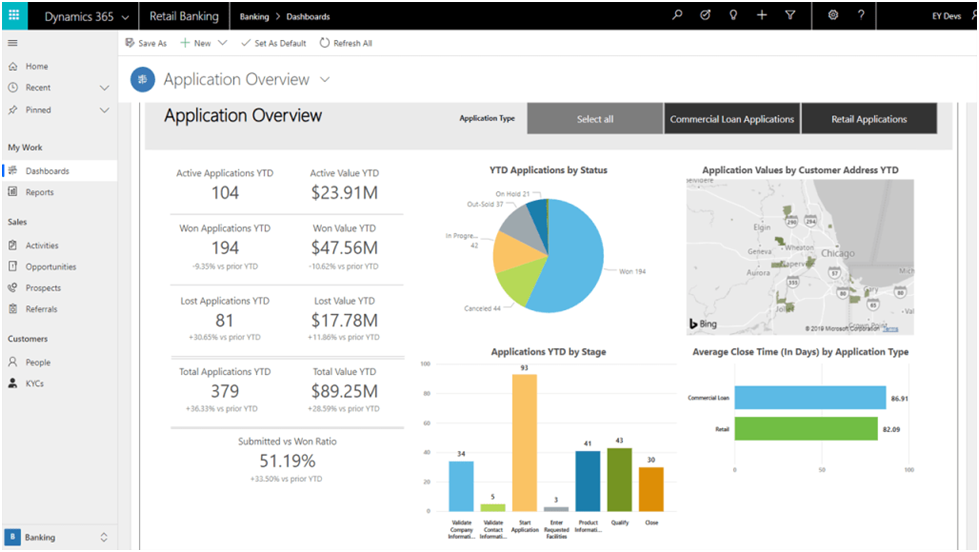

Banks utilize a wide variety of attributes and entities to provide the desired experience for their customers. These entities can include loans, branches, referrals, financial products, and more. The financial services accelerator includes these entities, along with sample apps, a banking data model, dashboards, and connected experiences. Dynamics 365 Financial Services Accelerator focuses on key components of retail and commercial banking to improve customer experience.

Compliance with the industry-standard data model

To ensure compliance with the industry-standard data model, the data model was developed in collaboration with BIAN and other open API initiatives. BIAN is committed to providing the best banking architecture. BIAN’s collaboration with Dynamics 365 Financial Services Accelerator ensures that the resulting solution is interoperable across networks and devices.

An open-source solution for all

Unlike other Microsoft proprietary solutions (such as the Dynamics 365 Sales, Marketing), the financial services accelerator is open source. Microsoft has created a repository on GitHub where ISVs, partners, and other financial services customers can access and contribute to its growth. Within this accelerator are sample apps, a banking data model, dashboards, and connected experiences.

This is why the service has been generally available since April 2020 and not much information is has been published by Microsoft concerning the release waves.

What’s new with the Dynamics 365 Financial Services Accelerator?

Since 2020, Microsoft has been releasing more features to increase the functionality and usability of this industrial accelerator. For the 2020 release wave 1, Microsoft added additional entity mappings to support insurance and wealth planning. This extends the application of these services outside the conventional bank setting to insurance organizations and more. For the second release wave, new capabilities concerning wealth management and mortgage experience have been added.

With accelerators such as the Dynamics 365 Financial Services Accelerator, Microsoft was a bit unorthodox with their offering. However, it is a very generous offer to allow ISVs and other customers to share the Power Platform in realizing groundbreaking solutions.